Annual Report 2017

157

Notes to the

financial statements

31 march 2017

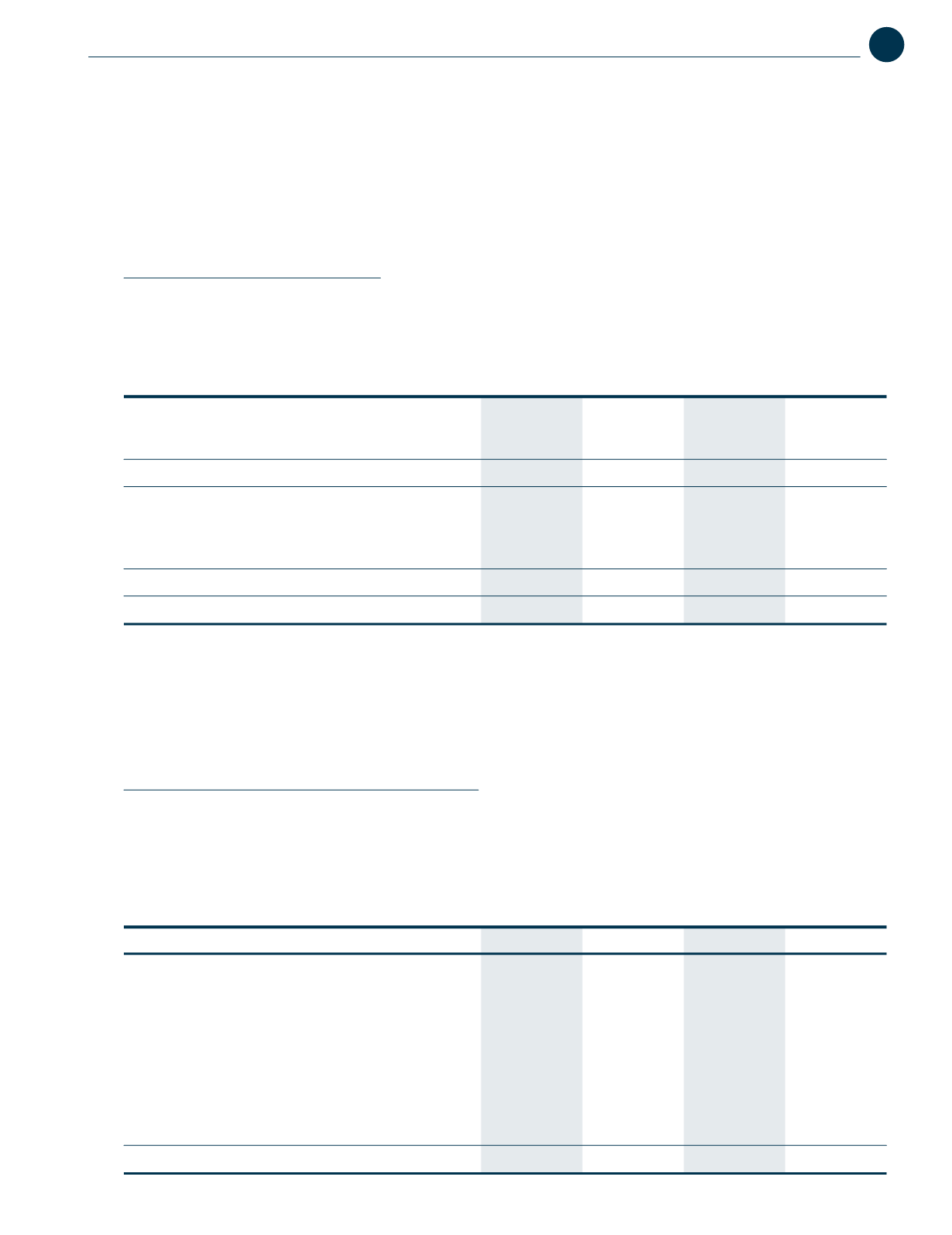

10. Income tax expense

Major components of income tax expense

The major components of income tax expense for the years ended 31 March 2017 and 2016 are:

Group

Company

2017

2016

2017

2016

RM’000

RM’000

RM’000

RM’000

Current income tax:

- Malaysian income tax

39,966

25,091

2,024

59

- Underprovision in prior years

3,037

2,991

1,659

911

43,003

28,082

3,683

970

Deferred tax (Note 28):

Relating to origination and reversal of temporary

differences

(9,504)

5,358

-

(160)

Under/(over) provision in prior years

744

(1,769)

(584)

10

(8,760)

3,589

(584)

(150)

Total income tax expense

34,243

31,671

3,099

820

Domestic current income tax is calculated at the statutory tax rate of 24% (2016: 24%) of the estimated assessable profit for

the year.

Taxation for other jurisdictions is calculated at the rates prevailing in the respective jurisdictions. During the current financial

year, the income tax rate applicable to the subsidiaries in Indonesia and Papua New Guinea were 25% (2016: 25%) and 30%

(2016: 30%), respectively.

Reconciliation between tax expense and accounting profit

A reconciliation of income tax expense applicable to profit before tax at the statutory income tax rate to income tax expense

at the effective income tax rate of the Group and of the Company is as follows:

Group

Company

2017

2016

2017

2016

RM’000

RM’000

RM’000

RM’000

Profit before tax

84,672

111,674

54,300

52,711

Taxation at statutory tax rate of 24% (2016: 24%)

20,321

26,802

13,032

12,651

Effect of income not subject to tax

(695)

(135)

(13,428)

(12,952)

Effect of tax rates in foreign jurisdiction

1,153

1,065

-

-

Effect of partial tax exemption

(32)

(34)

-

-

Effect of expenses not deductible for tax purposes

10,310

2,463

2,420

200

Effect of share results of associates

(687)

(400)

-

-

Deferred tax assets not recognised in respect of current

year’s tax losses and unabsorbed capital allowances

92

688

-

-

Underprovision of income tax expense in prior years

3,037

2,991

1,659

911

Under/(over) provision of deferred tax in prior years

744

(1,769)

(584)

10

34,243

31,671

3,099

820