Kumpulan Fima Berhad

(11817-V)

186

Notes to the

financial statements

31 march 2017

27. Retirement benefit obligations (cont’d.)

(b)

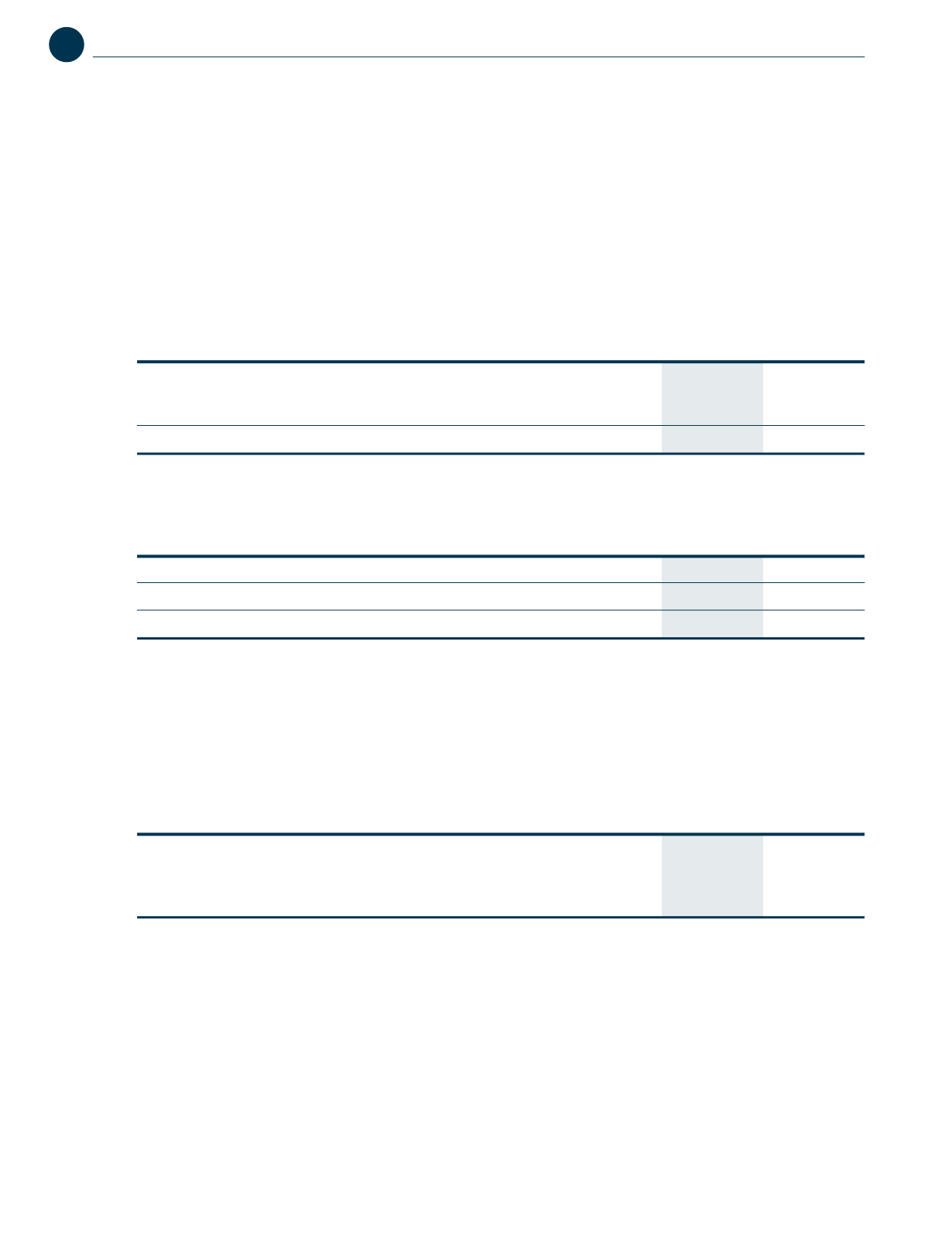

The amounts recognised in the profit or loss are as follows:

Group

2017

2016

RM’000

RM’000

Current service cost

199

19

Past service cost

-

(19)

Interest cost

85

69

Total, included in employee benefits expense (Note 6)

284

69

(c)

The principle assumptions used by the foreign subsidiary in Indonesia in determining employee benefits liability as of

31 March 2017 and 2016 are as follows:

2017

2016

Discount rate

7.8%

8.7%

Annual salary increase

7.0%

7.5%

Retirement age

55

55

The discount rate is determined based on the values of AA rated corporate bond yields with 3 to 15 years of maturity,

converted to estimated spot rates.

Significant actuarial assumptions for determination of the defined benefit obligation are discount rate and expected

salary increase. The sensitivity analysis below has been determined based on changes to individual assumptions, with

all other assumptions held constant.

2017

2016

RM’000

RM’000

A 1 per cent decrease/increase in discount rate will increase/ decrease the defined

benefit obligation by

143

121

A 1 per cent increase/decrease in expected salary growth will increase/decrease the

defined benefit obligation by

129

104

The sensitivity analysis presented above may not be representative of the actual change in defined benefit obligation as

it is unlikely the change in assumptions would occur in isolation of one another as some assumptions may be correlated.

The methods and types of assumptions used in preparing the sensitivity analysis did not change compared to the

previous year.