Kumpulan Fima Berhad

(11817-V)

34

MANAGEMENT DISCUSSION

AND ANALYSIS

Profit Attributable to Equity Holders

of

the Company declined 47.4% or RM26.89

million from RM56.73 million recorded in

FYE2016 to RM29.84million in FYE2017.

The marked decline was mainly due to

lower contributions from Plantation and

Bulking divisions.

Expenses and Liabilities

Cost and Expenses

before finance costs

and share of profit of associates for

the Group in FYE2017 was RM474.85

million compared with RM443.43 million

in 2016. Higher costs and expenses

were mainly due to increase in other

expenses of RM52.62 million in FYE2017

due to impairment loss compared to

RM24.02 million in previous year and

administration expenses of RM71.87

million in FYE2017 compared to RM63.54

million last year.

Total Liabilities

increased by 6.2%% to

RM197.87 million in FYE2017. The increase

was largely due to higher trade and other

payables (RM112.46 million) of which

RM84.59 million relates to the amount

payable by Manufacturing Division.

Capital Expenditure (“CAPEX”)

Total Assets

increased by 3.3% to

RM1.22 billion in FYE2017, attributed

to the increases in, biological assets,

other receivables and cash and cash

equivalents

.

For FYE2017, the Group incurred a total

of RM44.49 million for CAPEX comprising

of biological assets expenditure

(RM30.23 million) and property, plant &

equipment (RM14.26 million). The Group

retains strong discipline on CAPEX,

with generally conservative business

considerations and realistic benchmarks

used to commensurate with the nature

and risks of the activity or project.

Liquidity and Capital Resources

The Group’s cash and cash equivalents

increased to RM367.78 million as at 31

March 2017 compared to RM247.59

million last year. Net operating cash flow

generated in FYE2017 totaled RM192.97

million against RM107.88 million recorded

last year.

The Group finances its operations

through cash generated from operations

and a mix of short-term bank credit

facilities. This provides the Group with a

balanced range of funding sources.

On the basis of our current cash,

cash equivalents, and other financial

resources, the ability to generate cash

from operations, we believe we have the

capital resources and liquidity necessary

to meet our commitments, support

operations, finance capital expenditures,

support growth strategies and fund

declared dividends.

Shareholders’ Equity

stood at RM1.03

billion, up 2.7 % over the last year due

to increase in the Group’s retained

earnings.

Return on Equity (“ROAE”)

declined to

5.0% in FYE2017 from 8.1% recorded in

the previous financial year in tandem

with the decrease in net earnings.

Return on Capital Employed (“ROACE”)

declined by 25.7% to 8.0% in FYE2017.

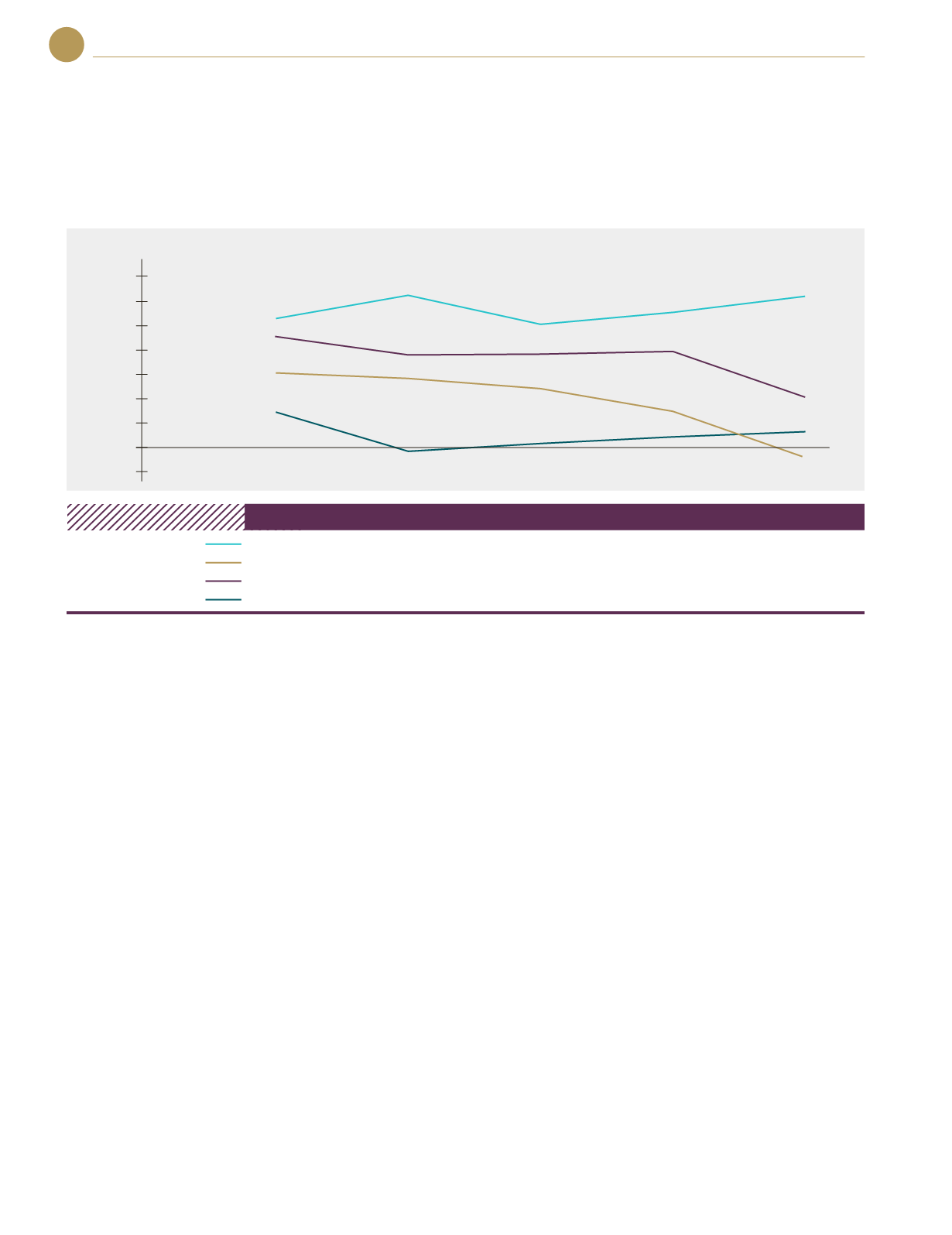

Division PBT Performance 2013-2017 (RM million)

2013

2014

2015

2016

2017

Manufacturing

53.15

63.39

50.54

54.01

59.61

Plantation

30.56

27.33

24.73

14.78

(5.96)

Bulking

42.81

37.28

38.08

38.88

20.00

Food

14.32

(3.44)

0.28

4.72

6.52

70

60

50

40

30

20

10

0

-10

2017

2016

2015

2014

2013