1 8 9

NOTES TO THE FINANCIAL STATEMENTS

31 MARCH 2018

Kumpulan Fima Berhad (11817-V) •

Annual Report 2018

39. Financial risk management objectives and policies (cont’d.)

(c) Foreign currency risk (cont’d.)

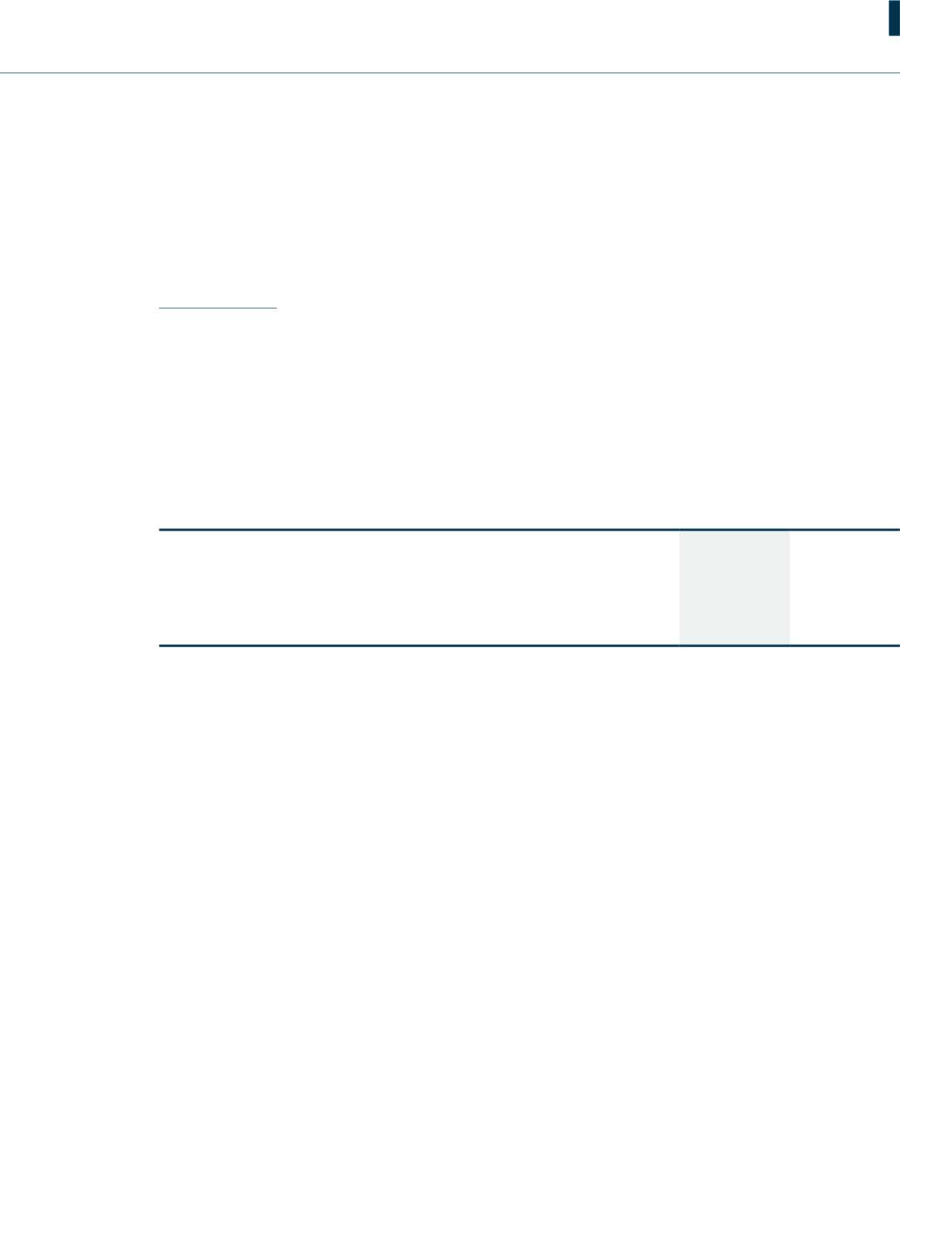

Sensitivity analysis

The following table demonstrates the sensitivity of the Group’s profit net of tax to a reasonably possible change in the

Indonesian Rupiah (“IDR”) and Papua New Guinea Kina (“PNGK”) exchange rates against the functional currency of the

affected group companies (“RM”) with all other variables held constant.

Group

2018

2017

Effect on

profit

net of tax

Effect on

profit

net of tax

RM’000

RM’000

IDR - strengthen 5% (2017: 5%)

1,786

2,578

IDR - weaken 5% (2017: 5%)

(1,786)

(2,578)

PNGK - strengthen 12% (2017:7%)

3,927

1,898

PNGK - weaken 12% (2017:7%)

(3,927)

(1,898)

(d) Credit Risk

Credit risk, or the risk of counterparties defaulting, is controlled by the application of credit approvals, limits and

monitoring procedures. Credit risk is minimised and monitored via strictly limiting the Group’s associations to business

partners with high creditworthiness. Trade receivables are monitored on an ongoing basis via Group management

reporting procedures.

The Group does not have any significant exposure to any individual customer or counterparty except with the government

agencies as disclosed in Note 20. The Group does not have any major concentration of credit risk related to any financial

instruments.

40. Capital management

The primary objective of the Group’s capital management is to ensure that it maintains an optimal capital structure in order to

support its businesses and maximise shareholders’ value.

The Group manages its capital structure and makes adjustments to it, in light of changes in economic conditions. To maintain

or adjust the capital structure, the Group may adjust the dividend payment to shareholders. The Group’s approach in managing

capital is based on defined guidelines that are approved by the Board.

There were no changes in the Group’s approach to capital management during the year.