3 9

Kumpulan Fima Berhad (11817-V) •

Annual Report 2018

Food Division recorded strong revenue growth of RM129.27 million, up 13.1% from

RM114.26 million last year. Higher sales volumes, favourable product mix and higher

selling prices in most product segments had positively impacted revenues during the

year. However, PBT declined by RM5.16 million compared to the same period last

year due to the forex losses of RM8.53 million. The weak Kina has had a significant

effect on IFC, our PNG subsidiary, thereby impacting on KFIMA Group’s earnings

results, both in terms of the negative forex translation of IFC’s operations from Kina

to Malaysian Ringgit and on the cost of raw material purchases, which are largely

denominated in US Dollars.

The Division has put in place a renewed

focus on marketing and sales and we

are pleased with our momentum on

this front as underlying sales trends

continue to strengthen for both local

and export markets. Overall, IFC sold

645,871 cartons of canned products, an

improvement of 12.8% over last year.

Exports of tuna products to the European

Union, IFC’s major export destination,

increased favourably both in terms of

volume and value, especially for tuna

loins. The mackerel segment grew 4.0%

volume-wise and 4.5% in terms of value.

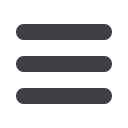

Revenue

CONTRIBUTION BY COMPANY (RM’MILLION)

IFC Revenue

CONTRIBUTION BY PRODUCT (%)

Profit before tax

CONTRIBUTION BY COMPANY (RM’MILLION)

108.21

5.80

6.05

0.72

* Due to the forex losses of RM8.53 million

FYE2017

FYE2017

FYE2017

FYE2017

IFC

IFC

FISB

FISB

122.68

0.31

6.59

1.05

▲

13.4%

▼

*94.7%

▲

8.9%

▲

45.8%

FYE2018

FYE2018

FYE2018

FYE2018

Mackerel

···························

53.2%

Tuna - Export Can

··············

25.5%

Fish meal

····························

0.3%

Tuna - Loin

··························

9.6%

Tuna - in house (Local)

�����

11.4%

Food Division