page

23

KUMPULAN FIMA BERHAD

(11817-V) |

Annual Report

2016

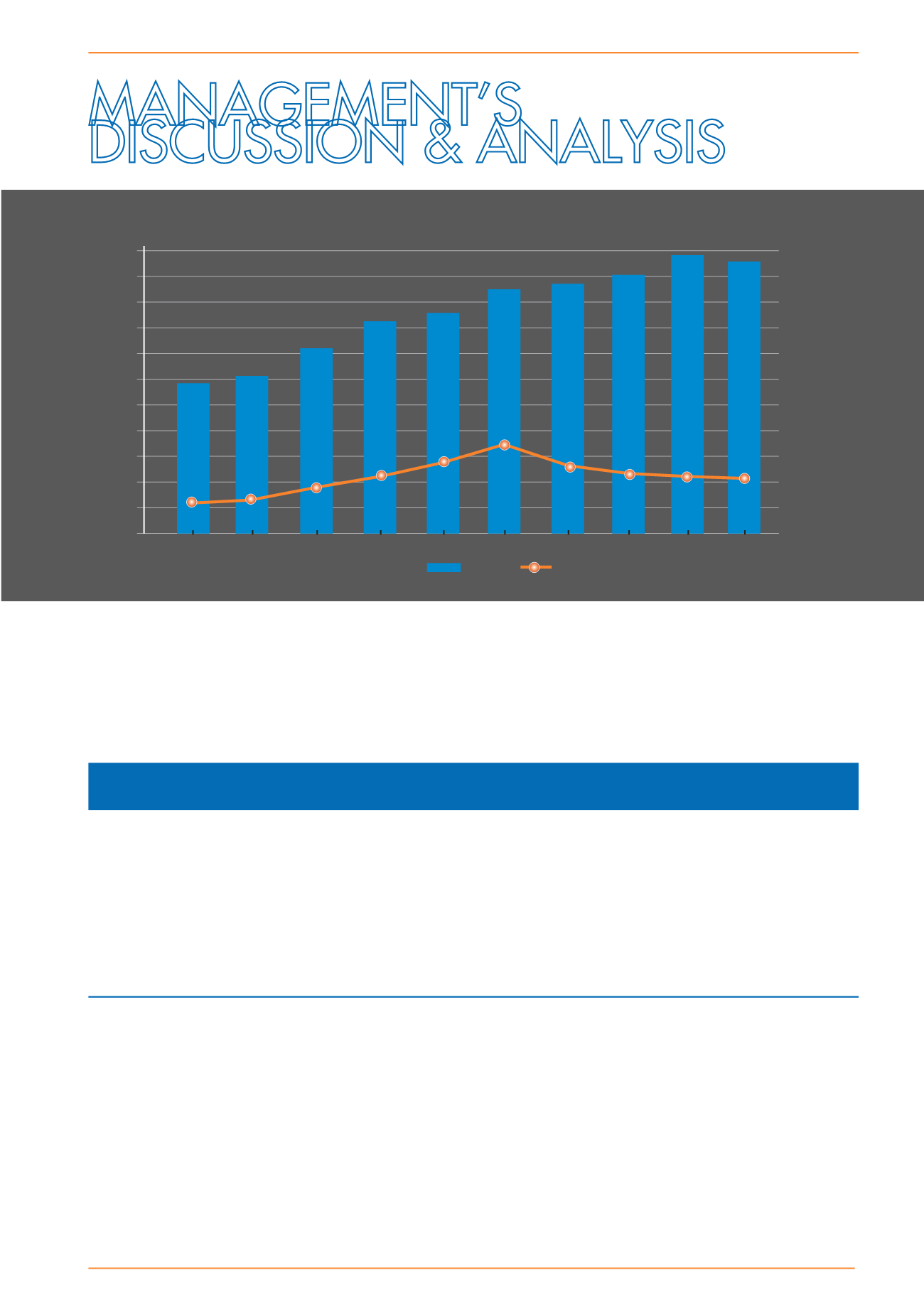

2009

2010

Revenue

PBT

2007

2008

2013

2014

2015

2016

2011

2012

51,389 56,862

81,193

115,726

140,930

153,812

142,016

129,362 122,302 111,674

294,397 308,712

369,070

411,432

431,884

470,753 486,524

504,586

544,789

541,107

0

50

100

150

300

250

200

350

400

500

450

550

RM ‘000

Years

Key Performance Indicators

INTRODUCTION

The Group’s principal activities remain unchanged throughout the financial year. The purpose of this review is

to highlight and provide brief insights on key financial and operating information at Group level. A more detailed

commentary on operating performance is covered under the respective business segment reports.

KEY FINANCIAL INDICATORS

Change

FYE2016 FYE2015

%

Revenue

RM million

541.11

544.79

(0.7)

Earnings Before Interest And Taxation (EBIT)

RM million

112.19

122.65

(8.5)

Profit Before Tax (PBT)

RM million

111.67

122.30

(8.7)

Profit After Tax (PAT)

RM million

80.00

84.02

(4.8)

Return On Average Shareholders’ Equity (ROE)

%

8.1

9.1

(11.3)

Return On Average Capital Employed (ROCE)

%

10.7

12.8

(16.4)

Total returns to shareholders

- Gross dividend (per RM1.00 share)

sen

9.00

8.50

5.9

Net gearing

times

0.19

0.22

13.6

FINANCIAL HIGHLIGHTS AND INSIGHTS

At Group level, the results for FYE2016 versus FYE2015 are best compared and explained at three levels, mainly,

Revenue, PBT and PAT.

Revenue

decreased by approximately RM3.68million or 0.7% fromRM544.79million in the previous corresponding

year against RM541.11 million in FYE2016. The overall decline in revenue was largely attributed to the lower

revenue contributions from Plantation and Food Divisions.

Profit Before Tax

decreased by 8.7% to RM111.67 million from last financial year. The decrease is due to lower

contributions from Plantation Division and associate companies. In addition, higher provision of doubtful debts

and increase in operating costs in the Others segment have also contributed to the decrease in PBT.