Kumpulan Fima Berhad

(11817-V)

32

MANAGEMENT DISCUSSION

AND ANALYSIS

Revenue

The Group’s revenue for FYE2017 was

RM547.21 million, compared to RM541.11

million recorded last year. The increase is

attributable to improved revenue from the

Plantation and Food Divisions.

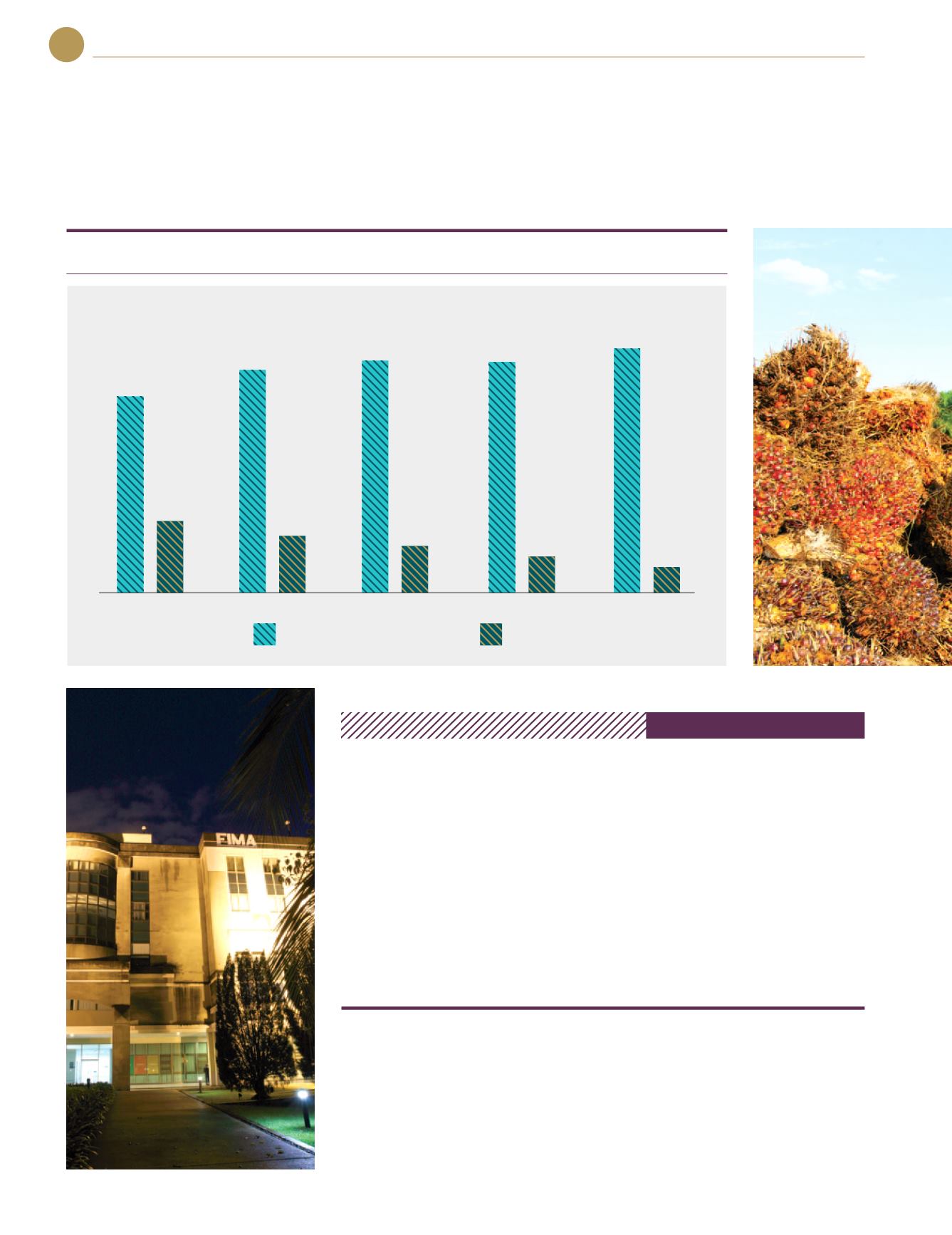

the group’s 5-year revenue and pbt performance

FYE2017 FYE2016 Change %

Revenue

RM million 547.21

541.11

1.1

Earnings before

interest and taxation (EBIT)

RM million 85.42 112.19 (23.9)

Profit before tax (PBT)

RM million 84.67

111.67

(24.2)

Profit after tax (PAT)

RM million 50.43

80.00

(37.0)

Return on average shareholders’

equity (ROAE)

% 5.0

8.1

(38.3)

Return on average capital

employed (ROACE)

% 8.0

10.7

(25.2)

Total returns to shareholders

- Gross dividend per share

sen 9.00*

9.00

-

Net cash flow generated

from operation

RM million 192.97 107.88

78.9

Net gearing

times

0.19

0.19

-

* subject to shareholders’ approval

Financial Highlights

(RM Million)

486.52

504.59

547.21

541.11

544.79

142.02

129.36

84.67

111.67

122.30

2017

2016

2015

2014

2013

REVENUE

PBT

Revenue from the Plantation Division

increased 30.4% or RM34.24 million due to

stronger Crude Palm Oil (“CPO”) and Crude

Palm Oil Kernel (“CPKO”) selling prices

despite the lower volumes of FFB harvested

compared to last year. Food Division also

recorded stronger revenue on the back of

improved sales in the tuna segment.