Annual Report 2017

39

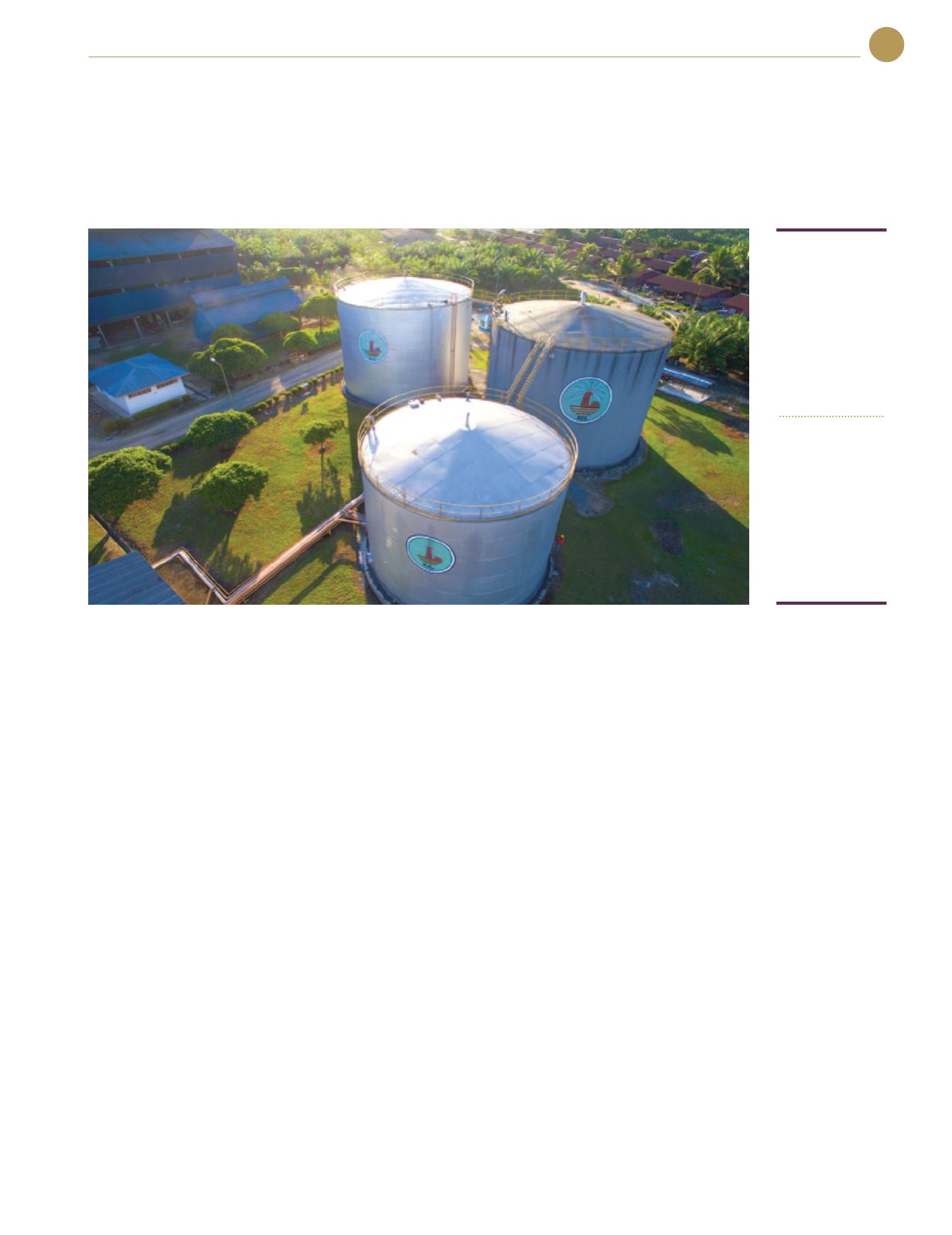

The

Group’s

Plantation

Division

recorded a revenue of RM146.87 million

for the year ended 31 March 2017, an

improvement of 30.4% from RM112.63

million recorded in the previous year as

a result of higher average selling prices

for CPO and CPKO. This was achieved

despite the decline in fresh fruit bunch

(“FFB”) production to 149,753 metric

tonne (“MT”) compared to the 164,738MT

harvested last year with an average yield

of 19.41MT per mature hectare (FYE2016:

21.26MT). The average price for CPO

(CIF, net of duty) registered during the

year was RM2,625 per MT compared to

RM2,064 per MT last year.

The rebound in CPO prices during the

year was a consequence of the lingering

effects of the El Nino weather pattern

which had caused dry weather thereby

resulting in a significant overall decline

in FFB production and palm oil stocks

which in turn pushed up palm oil prices.

Despite higher revenue on the back of

improved CPO and CPKO prices coupled

with lower cost of sales during the year,

the Division’s PBT registered a deficit

of RM5.96 million due to impairment

losses on property, plant and equipment

and biological assets in the Group’s

Indonesian subsidiary, PT Nunukan

Jaya Lestari (“PTNJL”) totaling RM29.37

million. Without the impairment losses the

division’s PBT would be RM23.42 million,

an improvement of 58.5% over last year.

As mentioned earlier in the Chairman’s

Statement, PTNJL has instituted legal

proceedings to challenge the revocation

of PTNJL’s land title under the Ministerial

Order issued by the Menteri Agraria dan

Tata Ruang/Kepala Badan Pertanahan

Nasional Republik Indonesia (“Ministerial

Order”). As a consequence, and although

the outcome of the appeal is pending,

PTNJL had decided to recognise the

impairment losses of the assets affected

by the State Administrative Court’s

decision on 13 June 2017 as the matter

indicates a material uncertainty that may

cast an adverse effect on the manner in

which the assets is expected to be used.

FFB

produced

by

PTNJL

fell

11.8%

to

131,484MT

(FYE2016: 149,060MT). A lower yield

per hectare of 20.6MT was recorded

compared to 23.2MT last year. FFB

purchased from third parties also

decreased to 51,853MT from 53,198MT

in the previous year. It is pleasing

to note that in Peninsular Malaysia,

FFB production of our Johor estates

have improved markedly by 11.7% to

17,194.49MT (FYE2016: 15,396.21MT) due

to better yield per mature hectare of

20.38MT against the 18.31MT achieved

last year.

CPO and CPKO production during

the year under review was 41,619MT

(FYE2016: 45,387MT) and 3,418MT

(FYE2016: 3,363MT) respectively. The

Group’s average oil extraction rate

(“OER”) of 22.7% was slightly higher

compared to the 22.4% OER recorded in

the previous year.

On the back of lower FFB production,

the volume of FFB processed declined

9.4% to 183,328MT from 202,406MT

in the previous year. The cost of FFB

production averaged RM337.7 per MT

while processing costs increased from

RM27.2 per MT to RM34.9 per MT in line

with the lower FFB processed.

PLANTATION

DIVISION

Contributing

26.8%

of total

group Revenue

- RM

5.96

million

division pbt